Want to test your Securities Industry Essentials (SIE) knowledge? In this article, you will find a guide to the topics covered on the SIE exam, and we’ve also included a few FINRA SIE practice exam questions that you can answer to gauge your current level of knowledge. Embedded within this post are the correct answers and detailed explanations to help you gain a better understanding of the concepts and increase your chances of passing the exam.

.

If you are planning to work in the finance and securities industry, one of the tests you need to take is the Securities Industry Essentials (SIE) exam. This exam, administered by FINRA, measures your fundamental knowledge of the industry, which includes types of products, risks, structure and function of the securities industry, regulatory agencies, and prohibited practices.

Unlike other securities exams, the SIE exam can be taken by individuals 18 years old and above with no experience, and without sponsorship or prior job offers in the industry. As such, the SIE exam difficulty level is classified as medium. It is meant to be challenging but approachable to anyone. It doesn’t hinder those who want to shift or start a career in finance. However, it would be easier if you already have a background or experience in the industry.

.

The SIE exam is made up of 75 questions in a multiple-choice format and administered via a computer. There are four general sections in the test, each carrying a different weight or equivalent number of questions. These are:

Section | Questions | Weight |

|---|---|---|

Section 1: Knowledge of Capital Markets | 12 questions | 16% of the test |

Section 2: Understanding Financial Products and their Risks | 33 questions | 44% of the test |

Section 3: Understanding Trading, Customer Accounts, and Prohibited Activities | 23 questions | 31% of the test |

Section 4: Overview of Regulatory Framework | 7 questions | 9% of the test |

Total | 75 questions | 100% |

While there are officially 75 questions in total, there are 10 additional and randomly placed questions that do not count towards the final score. So the best course of action is to never leave a question unanswered. Exam takers are given 1 hour and 45 minutes to complete the test and to get a score of 70 or higher to pass.

Do you think that’s a tough feat to achieve? Is the SIE exam difficult? Not if you study and plan well for the exam.

.

We’ve prepared a few questions that include the answers and explanations to help you assess your level of knowledge and determine which areas you need to improve and focus on. And also, to help you see what questions are on the SIE exam.

Please note that these are the type of questions you will encounter on the exam, but the actual questions may vary. In preparing for the Securities Industry Essentials (SIE) exam, you should be prepared for questions that will cover any section in the SIE exam structure outlined in the table above.

The correct answers to these FINRA SIE practice exam questions can be found below, but don’t cheat!

.

What is the tax status of Keogh plans?

a. Tax-deductible contributions and fully taxable distributions

b. Non tax-deductible contributions and tax-free distributions

c. Tax-deductible contributions and tax-free distributions

d. Non tax-deductible contributions and fully taxable distributions

.

2. Blake goes long 1 ABC Jan 40 put @ 7 when the market is 42. 7 months later, Blake closes the contract at intrinsic value when the market is at 39. What is the gain or loss?

a. $600

b. $500

c. $700

d. -$600

.

3. Which of the following is the best hedge against inflation?

a. Municipal bonds

b. Common stock

c. Preferred stock

d. Treasury bonds

.

4. Which of the following bonds will rise the furthest in price when interest rates fall?

a. 10 year 4% Treasury bond

b. 30 year 10% mortgage bond

c. 8 year 5% revenue bond

d. 14 year 6% debenture

.

5. What is the maximum maturity for commercial paper?

a. 180 days

b. 270 days

c. 30 days

d. 360 days

↓

↓

↓

What is the tax status of Keogh plans?

The correct answer is a. Tax-deductible contributions and fully taxable distributions

HR-10 plans, also known as Keogh (pronounced key-o) plans, are retirement accounts created for smaller professional practices (like a dentist’s office or law firm). Contributions to these plans are tax deductible, while distributions are fully taxable.

The full explanation can be found here: https://app.achievable.me/study/finra-sie/learn/retirement-and-education-plans-workplace-plans-defined-contribution-plans

.

Blake goes long 1 ABC Jan 40 put @ 7 when the market is 42. 7 months later, Blake closes the contract at intrinsic value when the market is at 39. What is the gain or loss?

The correct answer is d. -$600

The intrinsic value of an option is the difference between the strike price (40) and the market price (39) if the contract is in the money. Puts are in the money when the market price is lower than the strike price. Therefore, the intrinsic value is $1. The option was purchased for $7 and later sold for $1 (the intrinsic value), netting an overall loss of $600 (-$6 x 100).

Learn more here: https://app.achievable.me/study/finra-sie/learn/options-options-contracts-and-their-trading-markets-opening-and-closing-transactions

.

Which of the following is the best hedge against inflation?

The correct answer is b. Common stock

Common stock tends to outpace inflation (prices of goods and services rising), therefore investments in common stock can be used as a hedge (protection) against inflation. Fixed income investments (like preferred stock and bonds) are very susceptible to inflation and lose value when inflation rates rise.

The full explanation can be found here: https://app.achievable.me/study/finra-sie/learn/common-stock-risks-systematic-risks

.

Which of the following bonds will rise the furthest in price when interest rates fall?

The correct answer is b. 30 year 10% mortgage bond

Bonds with long maturities and low coupons have the most price volatility. Although some of the coupons are similar, maturity is the most significant factor for determining price volatility. Of the choices given, the 30 year mortgage bond has the longest time until maturity and exhibits the greatest price fluctuations when market dynamics change.

Learn more here: https://app.achievable.me/study/finra-sie/learn/bond-fundamentals-trading-market-prices

.

What is the maximum maturity for commercial paper?

The correct answer is b. 270 days

Commercial paper will not exceed 270 days to maturity in order to avoid registration with the SEC. Registration is a costly endeavor, requiring legal counseling and significant amounts of paperwork. A corporation will avoid registration if possible.

The full explanation can be found here: https://app.achievable.me/study/finra-sie/learn/corporate-debt-short-term-corporate-debt-commercial-paper

.

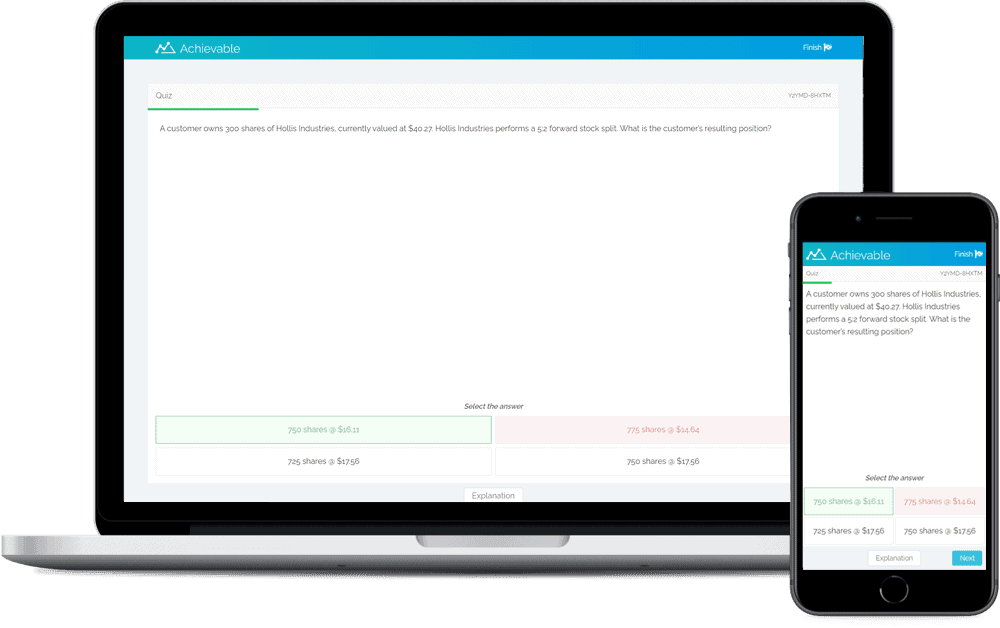

Achievable can help you get better by giving you the resources you need to practice SIE exams right in your own home. Our content was written by acclaimed FINRA instructor Brandon Rith who has helped thousands of learners successfully pass FINRA/NASAA exams while working at Fidelity Investments.

We’ve assisted many students to succeed and land their dream jobs as a finance professional. We can help you too. If you’re serious about a career in the finance industry and want to pass the SIE exam, buy our full course for only $74. You’ll have access to as many exams as you can take with our bank of 4,000+ SIE exam practice questions.

Achievable’s SIE exam prep materials include our online textbook, review questions, and full-length mock exams. Learn more here: https://achievable.me/exams/finra-sie/overview/

We teach you how to use hedging strategies in your options trading to limit your risk. This is both useful for retail traders and a key options topic tested on FINRA and NASAA exams.

We teach you how to use hedging strategies in your options trading to limit your risk. This is both useful for retail traders and a key options topic tested on FINRA and NASAA exams.

Unsexy but mighty, bonds represented $39T in net value WW in 2015, while stocks were worth approximately $26T. Basic Wisdom’s Brandon Rith walks you through how they’re handled in the wealth management profession.